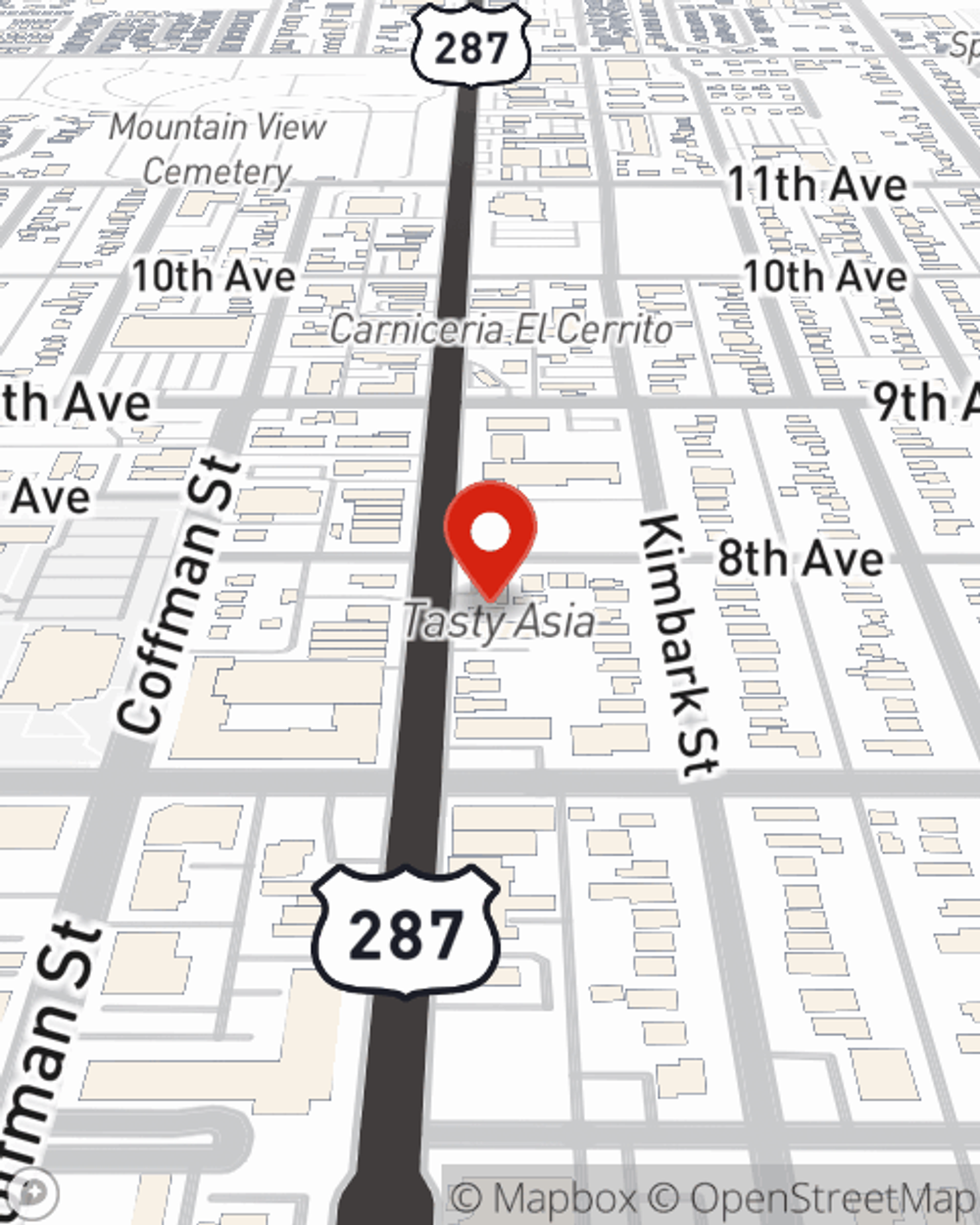

Business Insurance in and around Longmont

Longmont! Look no further for small business insurance.

Insure your business, intentionally

- Longmont

- Boulder

- Niwot

- Mead

- Lyons

- Erie

- Firestone

- Frederick

- Dacono

- Estes Park

- Berthoud

- Lafayette

- Louisville

- Nederland

- Broomfield

- Gunbarrel

- Superior

- Golden

- Westminster

- Vail

- Winter Park

- Summit County

- Loveland

- Beaver Creek

State Farm Understands Small Businesses.

Running a small business comes with a unique set of challenges. You shouldn't have to wrestle with those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including extra liability coverage, errors and omissions liability and a surety or fidelity bond, among others.

Longmont! Look no further for small business insurance.

Insure your business, intentionally

Surprisingly Great Insurance

Whether you own an antique store, a home cleaning service or a veterinarian, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by reaching out to agent Joe Chrisman's team to review your options.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Joe Chrisman

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.